Investment Framework [ V-L-R-T ]

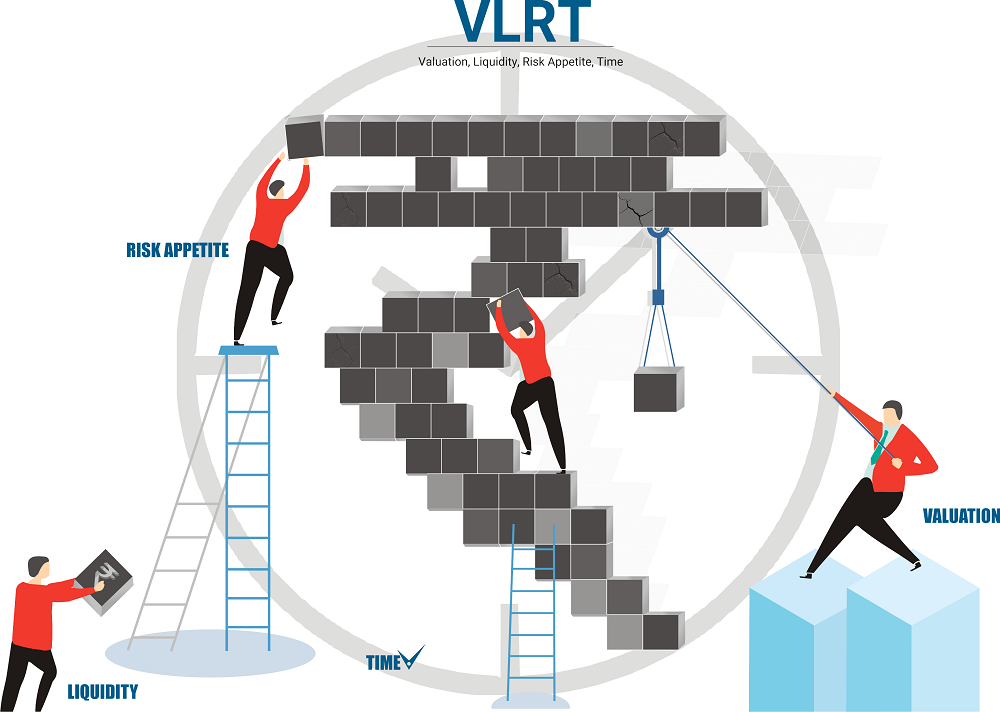

The core engine, which drives us and sets us apart, is a robust and differentiated investment framework that enables us to see beyond the horizon and stay relevant.

Our unique analytical framework for enabling ‘predictive analytics’ encompasses all available asset classes and sectors, formulating a multi-dimensional research perspective.

Why multi-dimensional?

The markets are a complex, dynamic system. There is no one formula or strategy or perspective that can consistently outperform.

A diverse set of variables and participants are continuously interacting with each other in myriad ways.

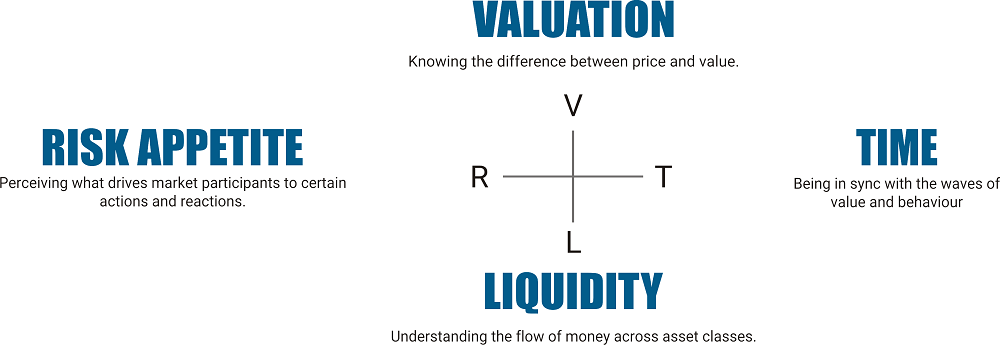

In the face of this uncertainty and complexity, instead of limiting ourselves to any one school of thought we have found consistent success by studying markets along four dimensions: Valuation, Liquidity, Risk Appetite, and Time. [VLRT Framework]

Valuation: Knowing the difference between price and value.

Liquidity: Understanding the flow of money across asset classes.

Risk Appetite: Perceiving what drives market participants to certain actions and reactions.

Time: Being in sync with the waves of value and behavior

Founded in 2008, quant Global Research (qGR) is the thriving heart and inquisitive mind that energizes and guides the quant Group platform. qGR is driven by a simple idea: to extract predictive clues on market trends, it is critical to look beyond the obvious. Multiple data points outside the popular domain must be collected and synthesized into investment decisions using alternate analytical methodologies, as only differentiated research can lead to novel insights. A truism for all markets is that when everyone has found the key, the lock has already changed. Explore the unexplored. While following convention and staying with the herd may feel comfortable, markets do not follow what is written in textbooks.

A decade ago, market research was focused primarily on the financial statements of a company, industry analysis and macro-economic studies to some extent. qGR began with a different idea about research with a focus on financial markets and the real economy as interlinked with feedback mechanisms, and a large emphasis on the role of investors’ dynamic behavior. This idea evolved into a multi-dimensional research perspective which is now formulated in our VLRT framework.

The ‘multi-dimensional’ aspects comes in because in addition to conventional qualitative analysis, qGR is extensively focused on quantitative measures and indicators of market patterns and various cash and derivatives market attributes. These diverse variables provide a picture of the inner workings and changing structure of various markets which form the ‘financial economy’. For the real economy, while formal economics is largely theoretical with assumptions-based models, qGR focuses on empirical market analysis, discovering a multitude of interlinked, overlapping though independently-driven cycles based on extensive historical data, going back centuries in some cases. Apart from cycles, pioneering research on global liquidity through alternate data sources enables quantification and tracking of the flow of money and its consequences across markets and asset classes.

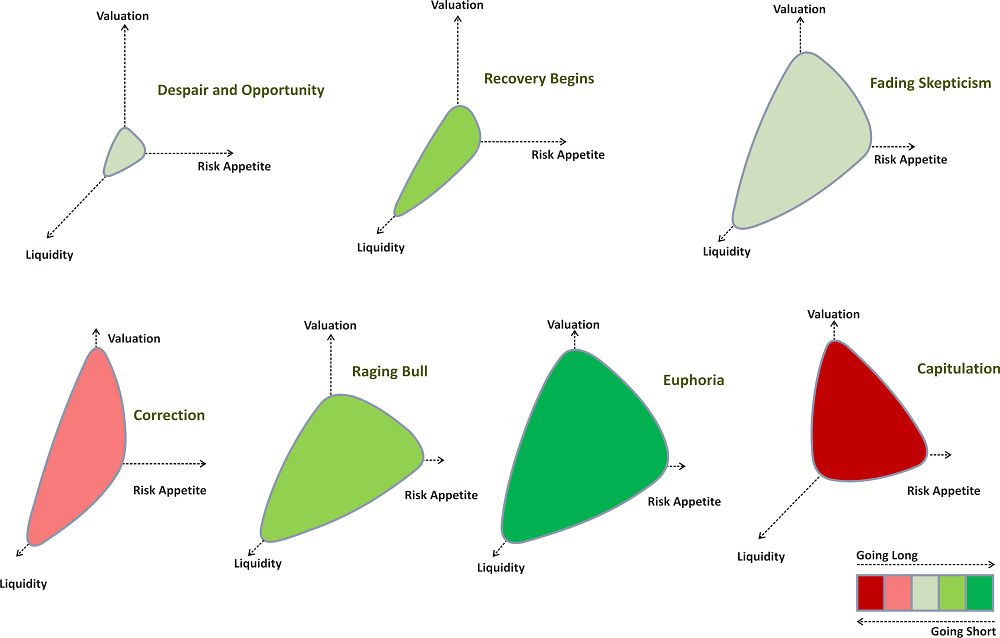

Going further, qGR behavioral analytics identifies the risk posturing of market and economic participants. The collective appetite of businesses and investors helps categorize the economic and market environment in zones of risk loving, neutral and risk aversion. Sentiment clues are also computed through proprietary risk indicators that enable us to quantify varying levels of fear and greed. Granular analysis specific to sectors or individual companies is also performed by identifying bouts of euphoria and panic.

Along with research, qGR provides a unique ‘Adaptive Asset Allocation’ execution methodology for money management. The various models, indicators and cycles are continuously being observed as they change with the market environment. Investment calls are triggered by certain observations in any one of the components, following which the call evolves based on further evidence from other relevant components. This endows our money management with an adaptive ability that we believe is the source of out performance. There is no search for a Holy Grail, it is about applying simple and time-tested market logic through a multi-dimensional lens.

“quant’s indicators are unique in their ability to condense multi-dimensional research into a one-dimensional single number. Our typical day starts with quant Risk Index, one metric that encapsulates risk across markets and across assets. The challenge has been of marrying momentum with qualitative research, and assimilating various macroeconomic variables and time series data with cross-sectional data. It has worked well for us and we hope to continue our best efforts in that direction.”

- Sandeep Tandon